IR35

We are the UKs tax payments and customs authority and we have a vital purpose. This will mean that from 6 April 2023 contractors working for an organisation via an intermediary will once again be responsible for determining their employment status and paying the appropriate amount of tax and national insurance.

Are You Ready For The New Ir35 Rules Fuse Accountants

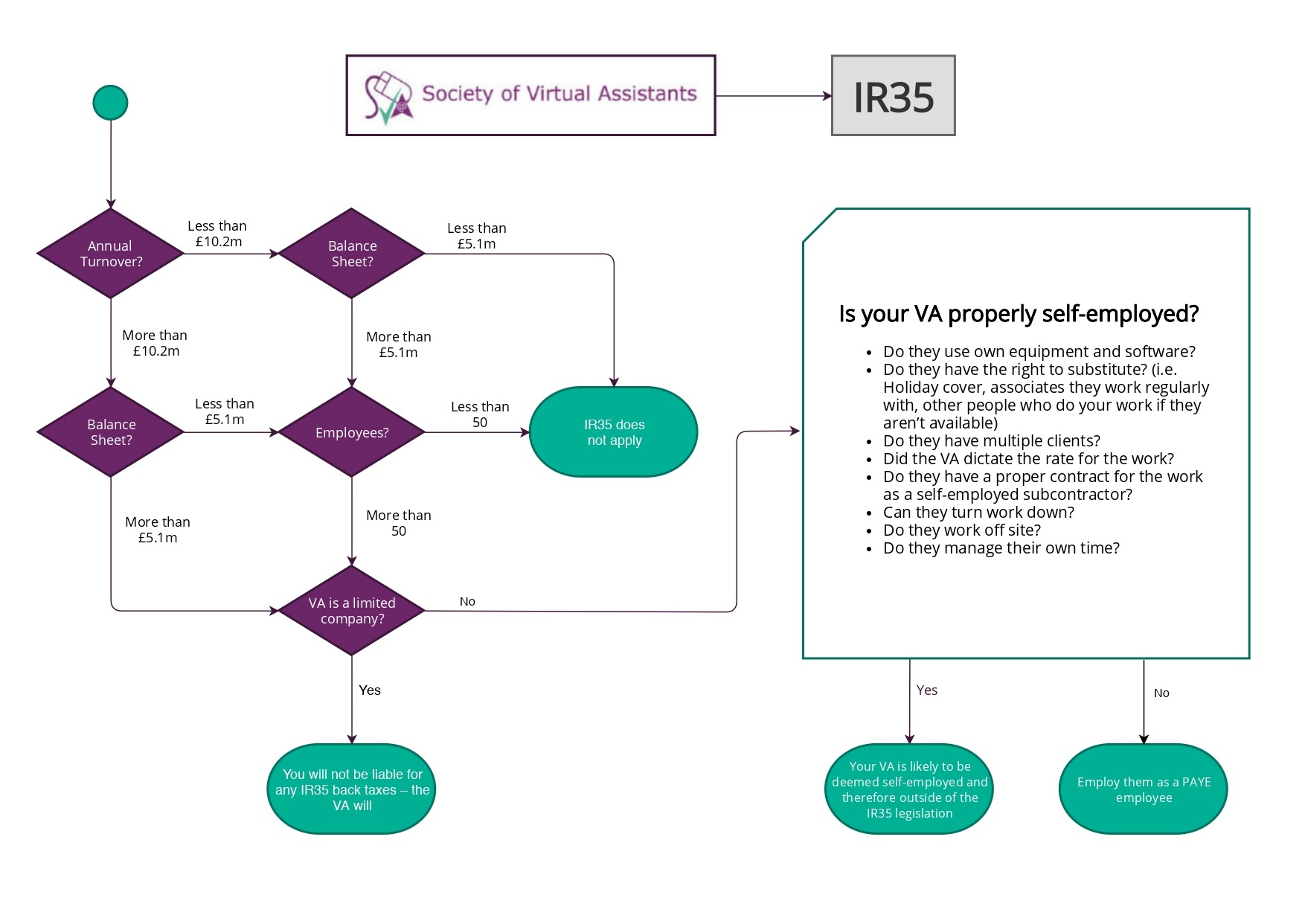

The off-payroll working rules are designed to ensure individuals working like employees but through their own limited company often known as.

. There is a very good chance that due to an abundance of caution many more assignments will be deemed inside IR35 use the IR35 calculator to make sure you are getting the best returns from these contracts. Our contractor calculator section provides you with a detailed illustration of what you could earn as a contractor. The abolishment of the tainted IR35 reforms is a massively welcome move for the entire contracting industry hard hit by the undue administration required to comply with the legislation.

Off-payroll working IR35 rules do not apply. When this happens the tool will give you further information to help you reach your decision. These rules are sometimes known as IR35.

Bringing a contractor inside IR35 can lower their take-home pay by 15 to 20 per cent compared with being taxed on a self-employed basis assuming the same cost to a company according to Kevin. IR35 expert Qdos chief executive Seb Maley said. List of information about off-payroll working IR35.

The off-payroll working or IR35 rules are designed to stop contractors working as disguised employees by taxing them at a rate similar to employment and it affects all contractors who do not meet HMRCs definition of self-employed. Previously this was set. The changes have created havoc for hundreds of thousands of independent workers along.

The latest regulation change which came into force in April 2021 forces medium and large businesses in the UK to set the tax status of their contractors and freelancers. By no means should you knowingly manufacture a pass from HMRCs IR35 CEST tool. IR35 contract assessments are reviewed by one of our experienced IR35 specialists who have a wealth of.

In this context disguised employees means workers who receive payments from a client via an intermediary for example their own limited company and whose relationship with their client is such that had they been paid directly they. Whether you are direct to client or via an agency the IR35 determination of your assignment is going to be out of your hands. IR35 became law in 2000 via the Finance Act and is another name for the off-payroll working rules.

29 April 2021. This will simplify the hiring process decrease the increase in costs brought by the inside IR35 assignments and bring back small businesses. Previously this was set.

The client is the organisation who is or will be receiving the services of a contractor. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. The off-payroll working rules IR35 have changed.

And with many agencies and clients asking contractors engaged outside of IR35 to sign a confirmation of arrangements any arrangements that dont align with your answers on HMRCs test will be easy to spot and could cost you an outside IR35 contract. The IR35 story is one which ITNOW has covered. U E½zÈHIëíጠ5 eáüý ø FÙbµÙ NÛãõñõóŸújüVS ÃÙŒ EJe NœµlÄؾ H À hfö¾oÞRûö³¾øDáþáA éê Ïî Ýžþ z 8JPe šR f Ÿ³A¾A²Q¼Qÿoi9 f óÈx Ê dyoæªUUWªªqÔÝÏ Ñé Hqì½oêW5ÐÝÉ r Æ8ŽcieìÚ R.

Advisers to contractors are divided over the highly likely prospect that HMRC will require a Status Determination Statement of limited company workers from April 6th 2023. Repealing IR35 reform is a huge victory for contractors. We collect the money that pays for the UKs public services and help families and individuals with targeted.

Having a IR35 contract assessment is an excellent way of demonstrating that you have operated due diligence in determining whether you operate outside of IR35 or not. They will also assist you with various tax loans and mortgage calculations. IR35 is a reform unveiled in 1999 by the UK tax authorities.

5 tips for consultants. We use some essential cookies to make this website work. Information has been added about working through an umbrella company.

They may also be known as the engager hirer or end client. If a repeal does happen it will result in contractors again being responsible for assessing their IR35 status in line with the original intermediaries legislation that has been alive since 2000. Given IR35 non-compliance this year is forecast at 430m Jenner Co says officials wont just do nothing to stop mass flouting of the original legislation which reapplies from 060423.

The reform of the IR35 rules - on how people working off the payroll pay tax - are designed to prevent workers setting up limited companies and paying less tax and National Insurance while working. Understand and prepare for changes to the off-payroll working rules IR35 if you are a client receiving services from a worker through their intermediary. You may receive an unable to determine result.

IR35 is a reform unveiled in 1999 by the UK tax authorities. Whether its operating through your own limited company or via an umbrella company inside or outside IR35 these calculations will help you work out what you could take home. Seven questions every contractor should ask about.

Reforms to the off-payroll working rules known as IR35 are to be scrapped from April 2023 the Treasury has announced. HM Revenue Customs. Changes to the IR35 rule were aimed at stopping employees from registering as freelancers in order to pay less tax.

Information about a delay due to the coronavirus COVID-19 pandemic removed. This can reduce the risk of penalties being applied if your status is subsequently challenged by HMRC. IR35 and off-payroll working.

IR35 refers to United Kingdoms anti-avoidance tax legislation designed to tax disguised employment at a rate similar to employment. The latest regulation change which came into force in April 2021 forces medium and large businesses in the UK to set the tax status of their contractors and freelancers. Wed like to set additional cookies to understand how you use GOVUK remember your.

After the reforms went live in April 2021 with a years delay due to Covid.

Ir35 The Good The Bad The Ugly Blog Explore Group Usa

Eliminating The Outside Ir35 Risk In 2 Simple Steps

What Is Ir35 And How Can I Prepare Starling Bank

What Is Ir35 Does It Apply To You How Much Are The Extra Taxes

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global

What Is Ir35 A Guide To Its Rule Changes

What Is Ir35 A Simple Guide To Making Sense Of Ir35 Crunch

What Is Ir35 And Why Is It Dangerous Ground For Independent Contractors

Ir35 What It Means For Interims Practicus

How Companies Can Prepare For The Ir35 Changes Med Tech Innovation

What Is Ir35 Here S What You Need To Know Freshbooks Blog

Ir35 Off Payroll Explained The Ultimate Guide To Ir35 And The Off Payroll Legislation For Hiring Firms Agencies And Contractors Chaplin Dave Gordon Keith 9781527260214 Amazon Com Books

The Ir35 Changes Are Here What Does It Mean For You Rouse Partners Award Winning Chartered Accountants In Buckinghamshire

What Does Ir35 2021 Mean For Sameday Couriers Da Systems

Ir35 For Virtual Assistants Society Of Virtual Assistants

Ir35 New Hmrc Consultation On Reform Of Off Payroll Tax Rules Jurit